Understanding dwell time

Port dwell time is the amount of time which cargo or ships spend within a port. It is a key indicator of how efficiently a port is operating, how quickly cargo is flowing through its terminals and how long a ship is spending in port.

The longer cargo is stuck in port, the more it costs shippers. This extra cost does not just come in the form of extra charges levied by the terminal operator or port authority, but in the greater inventory holding costs for the shipper. Cargo stuck in port means tied up working capital and prevents reliable Just-in-Time (JIT) procurement and manufacturing operations for importers.

But dwell time doesn’t just impact shippers, but ship operators too. Container vessels operate on schedules and a delay in any particular port is felt across the service. The shorter the dwell time, the lower the vessel and marine terminal operating costs.

Dwell times for non-containerised break-bulk, ro-ro, and tanker vessels and barges are influenced by different factors. These vessels usually do not operate on a schedule, and their time in port depends on cargo volume, cargo type, and cargo handling methods.

Container dwell time

The more delayed containers there are sitting in the yard, the longer it can take to locate and load the correct one. Every time a truck shows up to pick up a container, a stack of containers are shuffled around to reach the intended one.

This is a time‐consuming and inefficient process.

The longer the dwell times, the more containers sit on the quayside and truckers must wait for longer periods as containers must be moved to reach the older containers on the bottom of each stack.

Shorter dwell times occur when terminals are storing fewer containers and able to finish transactions more quickly.

Bulk shipping dwell time

Tanker and bulk carrier dwell times are governed by different factors than container vessel dwell times. These vessels do not operate published schedules.

Their times in a lightering zone or port may depend on:

• Weather, tides, and currents

• Cargo volume and type being delivered

• Cargo volume that must be lightered to allow mothership berthing

• Number of lightering vessels employed and lightering operations needed

• Remaining cargo volume the mothership must unload after lightering.

Key port components and their impact on dwell time

Berths

A berth is a place to stop and secure a vessel for cargo transfer. Container and breakbulk vessels need bigger berths as the full vessel length is needed to unload and load the cargo.

Ro-ro and bulk operations do not always require the length of the vessel. Insufficient berth availability leads to vessel delay.

A delayed vessel taking berth space impacts the port’s schedules.

Waterside access

How many channels, anchorages and waterways are available to ships outside the port?

Channels

The navigable waterways leading from open water to the terminal. These channels need to be maintained and dredged to ensure that they remain navigable to all ships. A lack of dredging and removal of sediment from the channel will lead to the port becoming inaccessible to the larger ships with deeper draughts.

Terminals

Ports have a number of terminals each with its own berths, storage and equipment. Terminal design, infrastructure and efficiency have a major impact on dwell time.

Supply Chain Connections

Road, rail and pipelines move the cargo into and away from the port. Rail is the main method of moving bulk commodities such as coal and grain. More efficient cargo handling is possible when rail facilities exist on-dock.

Cargo/container storage and chassis depots

The space that port terminals have for available for cargo. Off-terminal storage can include space for cargo before and after it is transferred to or from vessels; parking areas for empty and loaded containers, for truck chassis to haul containers, and for vehicles being transported in ro-ro ships; trackage to store rail cars; space to pile dry bulk cargo; tank farms for liquid bulk cargo; and warehouses for indoor cargo storage.

Weather

Adverse weather conditions lead to port closures and delays. High winds can mean that cranes cannot be used; floods and droughts can make inland channels unusable; ice and snowstorms mean some ports are regularly out of action in winter. How resilient a port is and how quickly it is able to resume normal operations are important.

Factors impacting dwell time

Developing world inefficiencies – Sub-Saharan Africa

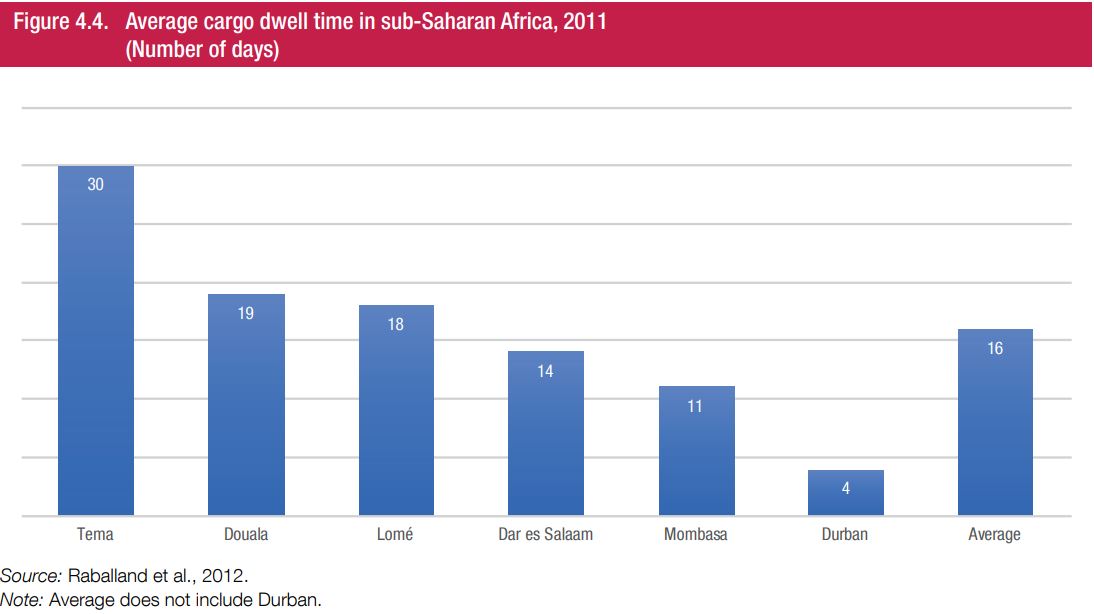

According to a 2018 report by The World Bank, cargo dwell time in Sub-Saharan African ports is abnormally long. Excluding the major ports of Durban, South Africa, and Mombasa, Kenya, average dwell time in most ports in Sub-Saharan Africa is close to 20 days compared to three to four days in most large international ports.

The report argues that the strategies of importers can lead to use of the port as a cheap storage area, while collusion of interests among shippers, intermediaries, and controlling agencies may reinforce rent-seeking behaviours, to the detriment of cargo dwell time.

Handling and operational dwell time add only two days (except in cases of severe congestion) to the average dwell time of 15 days and more. The bulk of the time pertains to transaction time and storage time, which result from the performance of controlling agencies and, even more importantly, from the strategies and behaviour of importers and customs brokers.

Unexpected volume peaks

During unexpected volume peaks, the terminal operators end up storing containers on every available space in their yards, even those locations not designed for storage.

This situation significantly lowers productivity.

While the strategy for most terminals includes space to handle surges, such as during peak seasons, when unexpectedly high volumes occur, a terminal’s capacity can be breached. Speaking on this with JOC earlier this year, Sean Pierce, President and CEO of Los Angeles terminal operator Fenix Marine Services commented:

“When container dwell times in yards quadruple from three days to more than 12, and truck turn times go from an average of 78 minutes in August to 98 minutes in January, terminals simply can’t flex up quickly enough.”

Automated ports

In a recent report, business consultancy McKinsey & Company suggests that automating processes limits the potential for human disruption and ensures more predictable port performance. At present though, poor data and siloed operations amongst other factors are impacting operational efficiency.

Through the Global Industry Alliance (GIA), MarineTraffic is invested in overcoming these operational barriers which are currently disabling greater port efficiency. The McKinsey report argues that should such efforts be successful, automated ports could, with careful planning and management, decrease operational expenses by 25 to 55 percent and raise productivity by 10 to 35 per cent.